Why are Young People leaving their Parental Household at 30 Years Old?

Whilst it comes as no surprise that Malta’s youths are moving out of their parent’s house later than older generations did, it begs the question—why are youths waiting so long to move out?

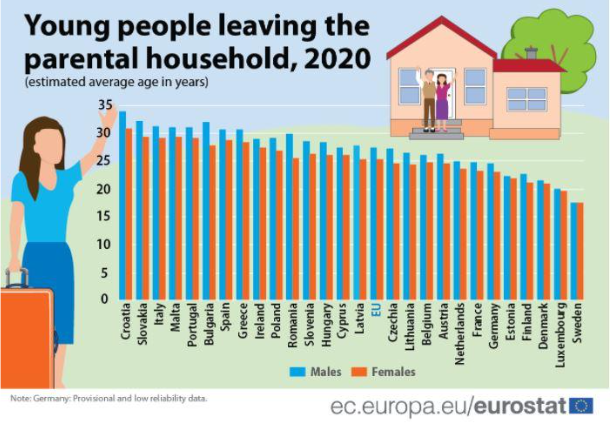

According to Eurostat’s statistics, Malta’s youths move out at around 30 years old.

It is often said that the millennial and gen z generations are comfortable. Why leave when you can stay at home and have everything done for you by your parents? Fair enough. But is that truly the only reason why? There are various socioeconomic factors which lead youths to live longer with their parents. During 2020, a year in which people expected an economic disruption within the property market due to the COVID-19 pandemic, almost all property types saw an inflation in prices:

Apartment prices rose by 6.5 %

Terraced house prices rose by 1.6%

Maisonette prices fell by 7%

Other properties: villas, townhouses prices rose by 12.4%

With an overall property price rise of 5% during 2020, youths are beginning to sweat. Although older generations glamourise the idea of being in one’s twenties, the reality is that the most common phrase in everyone’s mouth is: How will I ever be able to afford a house? With a cost-of-living allowance rise of €1.75 per week in 2021 and an average estimated monthly cost of a single person being €800 without rent, youths simply do not know how they will ever afford to buy a property in their 30s, let alone move out in their twenties.

Another factor is how ridiculously difficult it has become to qualify for a personal loan from banks. In her blog, ‘Moving on, up & away’, Rhi went through the gruelling process of trying to acquire a bank loan. Although she has lived in Malta for 10 years, has had a consistent job at a C-level position, has no debt and actually has a high salary, she was rejected from almost every bank on the island. Various factors come into play as to why people are rejected for a loan.

However, the sad reality is that it is even more exceptionally difficult when you are single. No, it is not the 1950s, I know, but the sad truth is that it is often easier to be granted a loan when you are married. Although it is true that some youths are delaying their move since they are choosing to marry and have children at a later stage in life, some youths simply do not have a choice. So, if one finds it easier to acquire a bank loan if they are married, this often entices youth to consider getting married before moving out. Getting married is one thing, but having a wedding is also another expense that youths have to consider before moving out. In reality, if you come from a middle-class family, you will have to work years to afford a wedding in the first place, delaying the moving out even further.

But what happens to those who are not even in a relationship? Although it’s common to be single in your twenties, the realities of it when it comes to one’s financial situation are less talked about. For the older generations, if you do not marry, you stay with your parents. But is that what the new thriving generations want? Most of them want their own independence, they just cannot afford it.

There is also the misconception that if you graduate from university, you will automatically get a high-paying job and be able to afford the cost of living. Although it is easier to find a higher-paying job when you continue your education, this is simply not always the case. In fact, most youths find themselves thinking: I wish I liked accounts or computing. Who wouldn’t? They are the two professions which are in most demand at the moment, the professions most marketed for—and with higher salaries, life is easier financially.

So what happens to those who dislike accounts but like the arts, tourism, and teaching? If you consider a graduate teacher’s salary—after an average of 5 years of study and graduating with a master's —it is set at €22,633 per annum, an average of €1,400 per month. Of course, there are people living on much less; it is doable. With €1,400 - €600 loan each month if you are single, this leaves you with €800 euro per month to live on. People have lived on less, but what quality of life are we living if we need to be workaholics to simply make ends meet?

It is true that some youths are comfortable. But for many, the sad truth is they simply do not know how they will ever manage to be independent in today’s economic climate.